Ray in play, but with whom?

Well, I’ll be darned. Raymarine’s stock jumped today, the company stated that “it has received a preliminary approach which may or may not lead to an offer being made for the company,’ and analysts can’t seem to figure out who the bidder might be. IBI suggests that Simrad, Garmin, and Furuno are all possibilities, but I’m hard put to see how any of those combinations makes much sense. The gossip line is open!

Microsoft ?

None of the above. I think Raymarine would be a tasty and classic choice for an investment group that believes they can take the company private and make it more profitable with a different strategy, management team, or cost structure.

Perhaps open up the scope of gossip to include what that strategy would be ? How might the product change in the future under a new strategy ?

Jeppesen Marine (Boeing)?

Raul

Maybe a well placed rumor to bring up their stock value? It lost about 50% of its value over the last year. Why else would they leak an unsubstantiated rumor?

Perhaps buyer is an industry analyst / reporter, who has formulated a better strategy for the business and has found an investment bank to help execute on that vision. Ben ?

I think Dan and Raul both have a point.

To Dan’s point, with a very low P/E and a very high ROE, they are certainly ripe for being taken private.

Jeppesen has been on the fence since their acquisition of C-Map. Historically a content and services company, they continue to sell hardware which I think sends a mixed message to the systems vendors who should be their customers. Maybe Jeppesen decided to get off the fence and into the systems business, but I’d be surprised.

Japanese firms are generally not very acquisitive so Furuno seems like a real long shot. I can’t see why it makes any sense for Garmin since given a couple of years they have the financial strength and whizzy products to take a share of Raymarine’s factory boat business by undercutting their prices (i.e., buy the market).

Navico seems like they have enough brands for awhile, but they have been doing a roll up, already have holdings in the UK and may see Raymarine as the next undervalued company. Of the existing companies they seem like the most likely.

Or it could be a new buyout fund just being opportunistic in a down market.

What struck me as really odd was for for Raymarine to make a public announcement. These kinds of “approaches” happen all the time and are never announced. Usually they don’t merit an announcement until there is a real conversation. So either there is more substance than they’ve suggested, or UK securities laws are different than US laws.

What about Lewmar?

Even though April 1 is past, one emailer’s takeover theory goes:

“Clearly someone’s excited about Raymarine’s new MarineShield™ product line. Maybe it’s Amway?”

I also laughed this morning when I read that Ray is hosting a series of UK roadshows during which English philosopher Tom Cunliffe will deliver a talk entitled: “Finding your position without losing your soul.”

http://www.bymnews.com/news/newsDetails.php?id=24568

I believe that it is from outside the Marine industry. It is from a larger player in electronics that is makeing a run in the US and trying to match up to Garmin…… My guess is Tom Tom.

For April first I put forward the idea of selling used lotto tickets on the commodity market. I felt the market was for individuals who had substantial gambling wins to buy losses at deep discounts.

Putting my creative mind to work…It has to be Paul Allen.

Lewmar seems like an interesting idea, until you realize how much smaller it is than Raymarine. BUT then if you check out Lewmar’s four-man board of directors you’ll find two named Swire, which apparently is quite a merchant family with considerable financial horsepower:

http://en.wikipedia.org/wiki/Swire_Group

If I stumbled, with Pietro’s help, on a real connection to the Raymarine bid, it’s just Google luck. And I really should be working on other things 😉

My money is on the Brunswick Group – if I had any!

Did anyone catch Jim Cramer (of Mad Money) as a guest speaking this morning on one of the news shows around 8am EST ?

He was hammering Garmins strategy and resulting performance. I didn’t catch all of it, but in large letters the screen showed Garmin Q1 Revenue down sequencially 40-50%. Ouch !

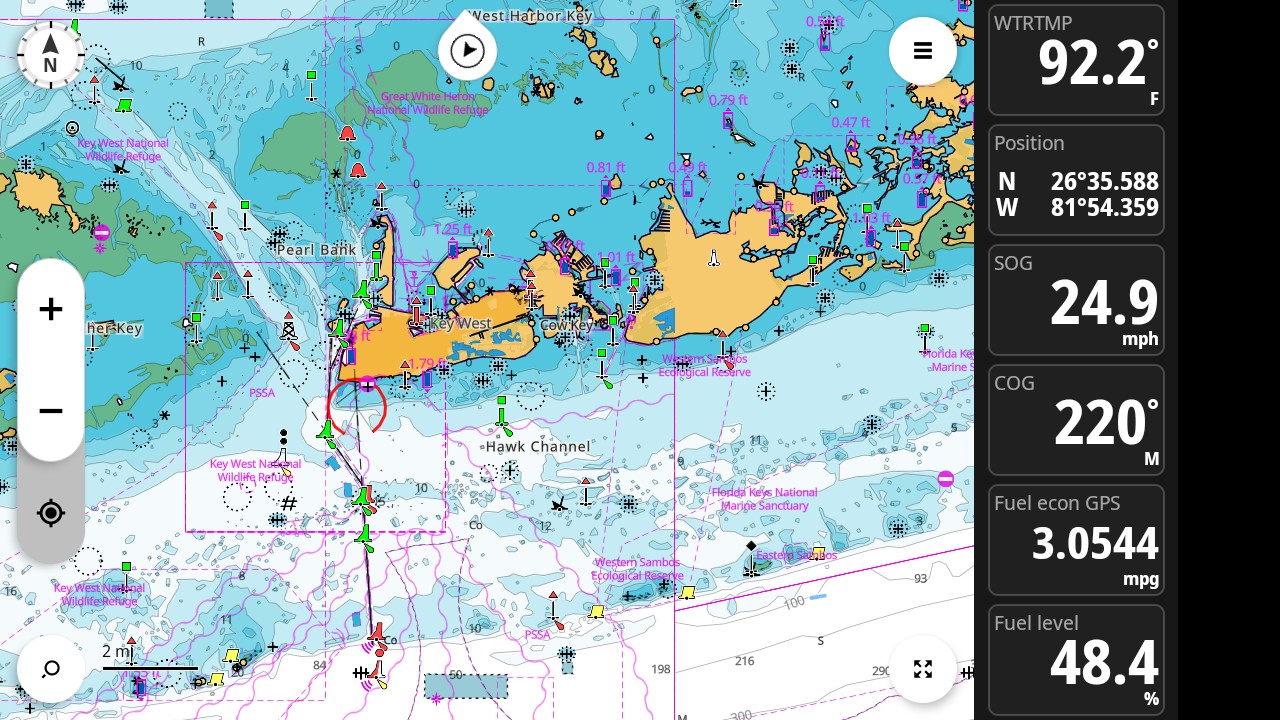

Garmin should be concerned. Smart phones with GPS will take away market share. GPSNavX coming to an iPhone very soon! And yes it will use the FREE NOAA RNC and ENC charts.

Dan – Do your homework. Cramer is a sensationalist. Garmin is a consumer electronics company, this means a big Q4 and a small Q1. Here are the 2007 numbers:

Q1: $492M

Q2: $742

Q3: $728

Q4: $1,217

“Down” 50% sequentially would be up 24% YOY for Q1. A lot of companies would love to be up “only” 24% YOY in a down economy!

Ouch! That stung Russ. I was just asking if anyone caught that.

Dan

Sorry Dan, but Cramer likes to make sensational points like that out of context, it’s how he makes a living. When you repeat them it gives them credibility, especially if people don’t check the facts and take it at face value. I’m not trying to be Garmin’s defender, but there is also no reason to start a rumor that they’re falling on hard times.

Dan, on further reflection, I could have, and should have, pointed out Cramer’s lack of credibility without singling you out. It’s been a long week and I apologize for my earlier comment.

Thanks Russ, I appreciate that, have a good weekend.

Snip from Scuttlebutt Europe #1489 18 April 2008

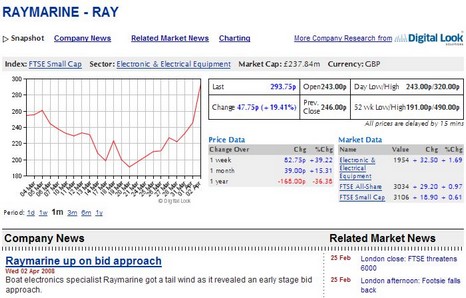

Raymarine stock rose on the London Stock Exchange following an announcement on Tuesday April 2 that the company had been approached for a possible takeover. The stock had been trading at 2.46 GBP and rose 27% to just over 3 GBP following the announcement.

‘The board of Raymarine notes the recent movement in its share price and confirms that it has received a preliminary approach which may or may not lead to an offer being made for the company,’ the company said in a statement.

Only last month. Goldman Sachs said Raymarine was ‘materially undervalued’ after its shares had halved in value from a peak of around 500p in April last year

There is much speculation over where the potential bid might come from with companies such as Garmin, Furuno and Simrad being mentioned, although many feel an approach from one of these is unlikely and an approach is more likely from a private equity buyer.