Navico’s numbers, should you care?

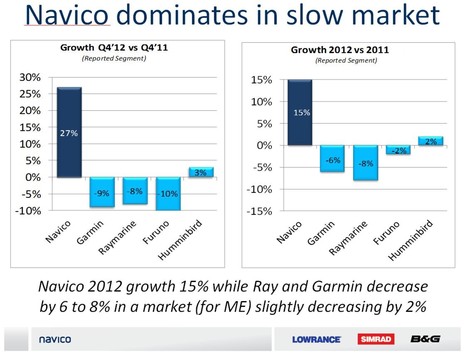

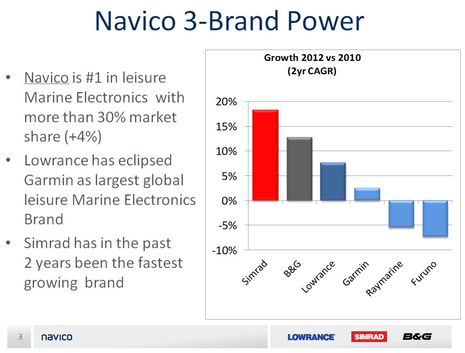

As a privately held corporation Navico doesn’t have to reveal anything about its financial state, but last week it issued a proud press release claiming a dramatic 15% sales increase in 2012, which resulted in revenues of 256 million dollars and EBITDA earnings of 41.4 million. And at the Las Palmas B&G event, the mother company added some claims about what their numbers meant versus the competition, as seen in the slide above. Is Navico painting a fair picture of where the recreational marine electronics market is at? Does it matter to consumers anyway?

Well, when I asked Navico’s CFO how confident he was about his competitor’s sales figures (apparently gathered in several ways), he first said “80 to 90 per cent” and then “let’s just call it 80.” I also passed these slides to a well-informed industry observer who’d already checked out the press release, and she (or he 😉 believes that Navico’s numbers are quite realistic except that “Furuno didn’t do as badly as that” (and also that Furuno’s commercial marine electronics division has been doing great). But let me be clear: If any company doesn’t feel fairly treated by Navico, please speak up or contact me directly, and feel free to include your own charts for possible addition to this entry.

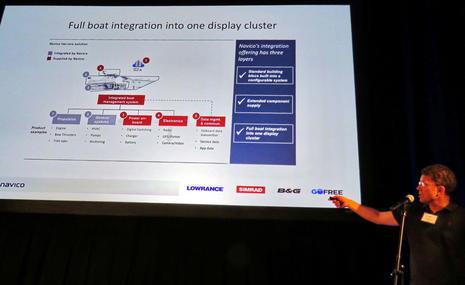

Should you care about business news like Navico picking up market share, at least in the short term? My answer is yes but not too much. When I recently created a Trawler Fest seminar about the state of primary navigation systems I made the case that we’re no longer just buying a product — bolt it down near the helm and use it until it’s done — we’re choosing a primary electronics company to move forward with. There’s a good chance that a system you buy today will already have a software update available by the time it gets installed, and it’s reasonable to hope that the system will continue to get improvements and bug fixes for a long time, not to mention new integration options like digital switching (Raymarine Miami 2013) or forward looking sonar (Garmin Miami 2012). Trends toward interoperability like NMEA 2000 and easy tablet integration ease the pain, but nonetheless choosing your primary system is becoming a bigger and bigger decision.

As an occasional stock investor, though, I’m more interested in stories than numbers, and right now it looks to me as if the plot lines at all the major manufacturers are moving along nicely. Sure, Garmin’s marine division may have had a tough 2012 — what with the camera disappointment and no other major releases — but no competitor is counting them out, that’s for sure (and they all wish they had The Watch). And I suspect that Raymarine’s sales decline is simply a hangover from the time when it was on the injured list (which was once occupied by Navico), and that consumers are realizing how irrelevant that’s become. What I see is a Big Four in saltwater marine electronics which have all streamlined their operations with unified development, (fairly) efficient manufacturing, and global distribution, a Big Four which is now surfing a giant wave of innovation and integration. Today’s consumer can’t go too far wrong, in my opinion, though I still encourage lots of research to get the system best suited to one’s particular style of boating and gizmology.

I surely look forward to the comments that will follow, but let’s first consider a larger point evident in these claims. Recreational marine electronics really is a “cottage industry” as the insiders joke. If Navico’s 256 million in 2012 revenues is “more than 30% market share,” doesn’t that mean that the five largest manufacturers (freshwater-oriented Humminbird gets included) took in about 825 million? Heck, my local semi-rural health conglomerate has revenues well about 100 million. And consider, say, the iPad, which had sales of 10.7 billion dollars during the last quarter of 2012. Yes, if my math is correct, essentially one consumer electronics product (iPad models aren’t much different) generated revenues of 839 million dollars per week, more than the five leading marine electronics companies generate in a year. The next time you get miffed because your navigation system doesn’t update itself as easily as a Mac, shouldn’t you consider the numbers?

My current 34′ power cat is Simrad equipped but I am switching to Garmin for our 47′ under construction and launching this Spring. Why?

Garmin has recently announced products – 8000 series, watch nav, Bluechart Mobile, Homeport ….

that working together are just too compelling to go elsewhere. Looking closely they also give promise for more leading product additions in the pipeline.

Brian

Ben,

That ME companies can significantly increase or lose market share from year to year is good for the ME consumer. Innovation and price seem to be leading reasons for market share changes. This should drive more R&D investment thus driving innovation, improvement, and manufacturing & marketing efficiency.

Better product, better price, more share.

My local view matches what Navico is saying. Way more Simrad and Lowrance in play here than a few years ago, when the top spot was for Raymarine and #2 was Garmin (for chartplotters).

My office window overlooks a canal, and so I see a lot of yachts passing by. That means my view is biased towards boats that get used, not boats that lie in marinas. If I spot a new radar it is usually a broadband radar.

I agree with you that all manufacturers seem to have their process in order now, and you can’t really choose badly if you go for any of these four. Personal preference will play a large role.

If I advise people on what to buy I start of with what type of boating they do. In my opinion, on a power/motor boat the main piece of equipment will (or should) be the chart plotter, on a fishing boat the fish finder, on a cruising sailing boat the auto pilot and on a racing sail boat the instruments and wind sensor. So I tell them to start with choosing that major piece of equipment and stick to the same brand (or group) for the rest.

Kees, my experience is exactly the opposite with Garmin and Ray dominating, then Simrad followed by Furuno. I have only installed a very few Lowrance units, and mostly helping people with transducer location and installation for structure scan systems. I think that since most of my work is on larger vessels, I don’t see much of the smaller dollar units of any brands. It’s hard to extrapolate growth numbers and derive actual sales dollars. I wonder how much of Navico’s mix is really made up of the lower cost Lowrance systems to fisherman who want the structure scan technology?

Kees, you are on the money with your purchasing advice. I abhor the idea of mixing and matching various manufacturers gear. You lose all of the integration features manufacturers work so hard to design into their systems.

Bill, how much of your installs are sailing boats? Over here I’d say the majority is sailing. This might have something to do with the cost of fuel: € 1.50 per liter, or about $ 7.50 per US gallon.

«start with choosing that major piece of equipment»

Radar was the driver for us. 4G.

This is a piece of bullshit marketing. Navicos revenues and financials are availble here:

http://www.purehelp.no/company/corp/navicoholdingas/987894717

All numbers in Norwegian krone. Numbers for 2012 is not filed yet.

Negative to flat revenue development and major losses for years. The company is owned by Altor and the bullish marketing message means to me that they are looking to sell the buisiness. A

Why Panbo no speak about another brands as Samyung….this is a very big & interesting company

It’s not too hard to figure why Lowrance is doing

so well.They have a good product that is aimed at the largest number of boaters, A look at the boating registration numbers in the U.S. shows far more bass boats and smaller fresh water craft than ocean going

boats. If I remember correctly, the state with the

highest number of boats registered is in the midwest.

Looking at the link posted by norway, navico is a company who has been bleeding badly during the financial crisis, but I would be surprised if this isn’t the case for the majority of companies in this business…

What I find more interesting is that they have been able to overcome the hurdles and for 2011 get close to zero losses… So if we are supposed to believe these informations posted by Navico, one would expect a decent result from 2012… Good news for us boaters as they need to make money to stay in business and use resources on R&D.

Kees, I only do a couple of sail boats a year. Because of the shallower waters in this part of the west coast of Florida there just aren’t a lot of sail boats here. I would guess they are about 5% of the market locally.

Having reported on the marine industry in the past on a daily basis I can assure you that none of these numbers can be trusted without verification and digging deeper–apples to oranges probably. There are so many different ways of spinning things that I doubt we are getting a realistic picture of the true financial situation or market share. Just one example that may or may not be applicable. Some boatbuilding companies report something like “shipments” are up 20% in the first quarter, meaning they have sent boats out to showrooms by giving dealers special incentives, but who knows if the boats will eventually sell. Some companies report this same activity as “sales,” which they might be technically, but I don’t consider it a sale until it is in the hands of a consumer. So you can see how these numbers get fudged.

Last time I examined U.S. boat registration stats … it was indeed true that there is a high concentration of small power in the Lakes region, and few sailboats in FLA (shallow water, age, etc.).

I recall sail being 10% of the market and racing sail 10% of that. I’m a 1%er

Navico lately is looking good. I like the Triton displays, the B&G ZB100 is attractive, the WiFi-1 looks reasonably designed, they know how to design a wind sensor, and the GoFree approach finally looks like a way to have MY data on a wider choice of display platforms.

Kees,

Great post on what folks should look for – depending on their type of sailing. I couldn’t agree more.

And agreed with the others on these numbers being likely soft. The garmin balance sheet for example looks far stronger than Navico, which may mean Garmin and others can do more R&D than Navico. Time will tell.

“we’re no longer just buying a product — bolt it down near the helm and use it until it’s done — we’re choosing a primary electronics company to move forward with”

I am not sure whether I am as enthusiastic. Fact is that all systems have their particular strengths and weaknesses and you should have the choice to get the best for your needs.

I am, for instance, not convinced that the broadband radar is really superior to other solutions, because the small antenna can get around basic rules of physics, even when supplemented by smart algorithms, so I went for a traditional, bigger one. I like (and use) the Maretron displays together with Raymarine i70s, also just because last year the Tritons were not yet announced and the Maretrons can display parameters the cheaper Rays do not show. The Simrad AI50 outputs proprietary Class B sentences which the i70 does not read (has been discussed here). As 3 year old Simrad autopilot does not output HDG with sufficient frequency to get radar stabilization working, so I had to install another compass (Maretron). While I have Maretron displays to perform calibration, I cannot upgrade any Maretron gear as I am currently lacking the right N2K interface for the computer. Unfortunatly, upgrading the i70s is only possible with a Raymarine MFD, that would be inferior to the Transas solution I use for charts and radar.

So, suppliers lock you into their systems, which limits choice and leads to duplication of gear. The good thing is that N2K helps to standardise basics. The bad thing is that N2K leaves too much flexibility for proprietary stuff (why perhaps not standardize autopilot control, calibration, switching of display pages), so that you end up with several manufacturer specific busses, at least on a single cable (with different plugs…)

Ben

This sort of press release always makes me nervous.

The underling question is has this gains in market share been profitable,

If it has been then great, so why the press release, unless they are going to sell.

Selling normally results in no R&D bad product support and retailers and dealers picking up the pieces.

David Lennard

As a PowerPoint Ranger myself, it seems like there’s not a lot of substance to these charts. Percentage this, percentage that. Let’s see some charts with a 3 to 5 year history showing revenue and profit comparisons and then I’ll believe that we are learning something of interest. I have seen (and created) too many of these PowerPoint slides over my career to be impressed with these.

Larry, I agree that there’s LOTS of business info not shown on these charts (like the overall Furuno sales growth noted by my industry observer). But no one seems to be arguing that these slides don’t show something about recent sales trends (though of course those can change, again).

If you look at the profit trend – that looks very good actually.

From 473 ml loss to 167 ml loss and 2011 only 16 ml loss – if they continue the trend profit should be around 80-100 ml for 2012 (Norwegian kroner)

That is an amazing trend while STILL putting out a lot of new products and doing R&D. And I do NOT think Navico is done surprising us.

Compare that to Garmin who has yet to launch a serious update to their MFD line in the $2000-$4000 segment (yes I know about the 8000 series – but that looks more like an “ups we forgot to do anything for 3 years and what can we scrape together quickly”) – The same goes for their “improvised basement hack Wi-Fi accesspoint” – that is only delivered with 110/220 volt power adaptor.

One thing is certain – Navico is doing everything it can to capture the $500-$5000 market and is doing it well. Broadband radar, NSS / HDS Touch / New B&G MFD’s – and latest affordable VHF with dual channel AIS and NMEA 2000 for

Regardsless of trends the company have not earned a penny since it was founded in 2005. Owned by a PE mean that they will pull the plug if needed to cut the losses.

Look what the same owner did with the well know and successful Swedish boat builder:

https://plus.ibinews.com/article/H079IpyguBM/2012/07/03/nimbus_boats_files_for_bankruptcy/