FLIR may sell Raymarine, don’t jump to conclusions

Last Thursday, Soundings Trade Only published “FLIR evaluates Raymarine sale” and resulting rumors about Ray’s troubled state are probably circulating already. Business must be bad if a sale is publicly contemplated, right? But the details of FLIR’s announcement only suggest that Ray is a small slice of a very large operation which thinks it can find more growth in other markets. Moreover, FLIR’s maritime electronics business was not identified as a factor in the earnings disappointment that was the company’s main news (unfortunately for investors).

So while it seems quite possible that Raymarine will become independent again, or part of a larger enterprise again, I see no evidence that the brand is failing, or that Ray users should get concerned. And the research also reminded me about the very small size of the entire recreational marine electronics industry — which is important to understand before you gripe about product prices, bugs, delayed shipping, etc.

These “FLIR Systems, Inc. Fourth Quarter and Full Year 2019 Results Conference Call” slides are available along with a lot more investor info here. And let’s note that the validity of such information is strictly regulated for publicly traded companies, with misrepresentations also subject to serious civil litigation.

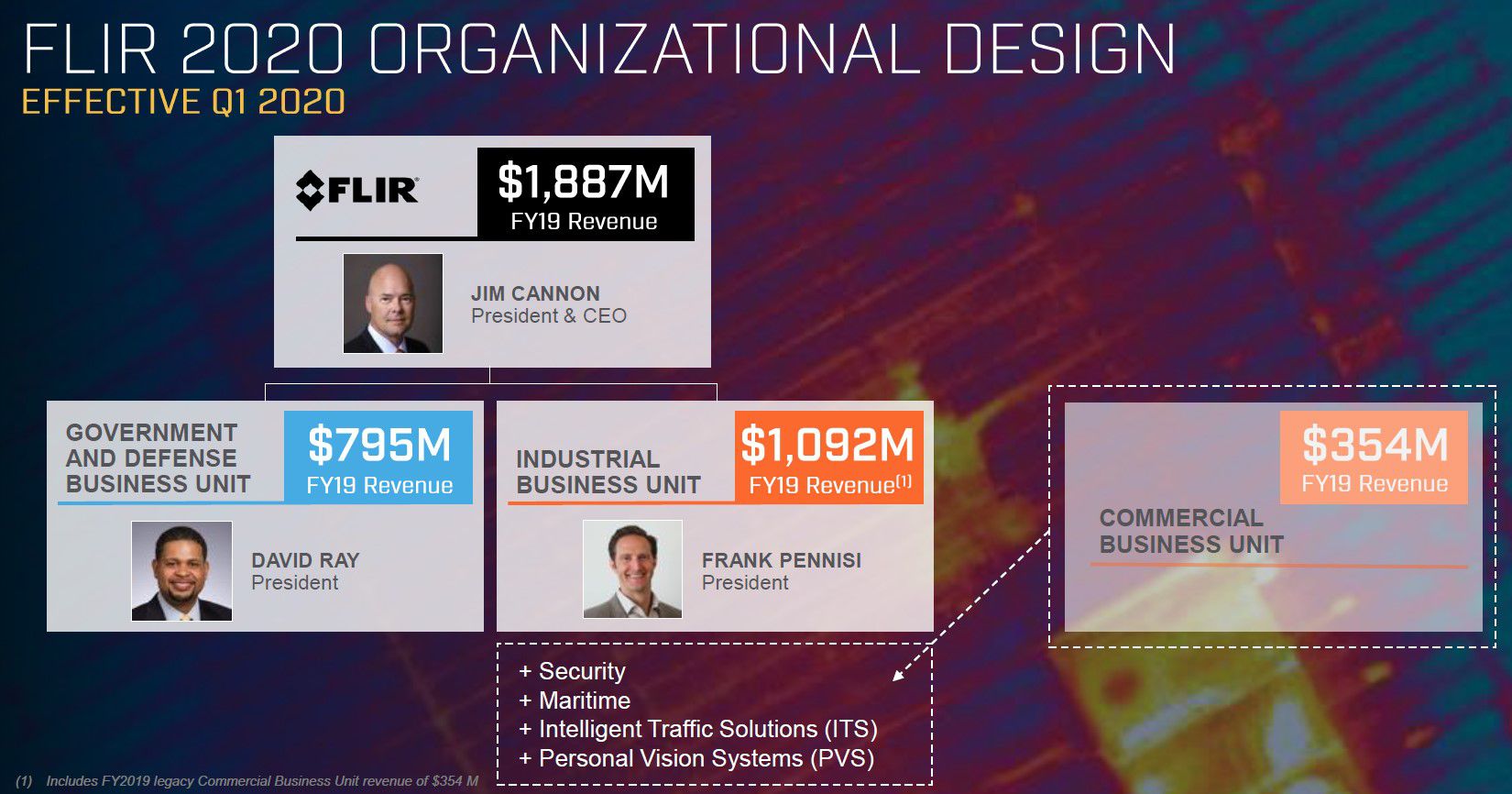

So FLIR sold 1.9 billion dollars of goods in 2019 — which is larger than the entire global recreational marine electronics market, I’m pretty sure — and its maritime sales was just a portion of its smallest business unit (which is about to be merged into its largest unit).

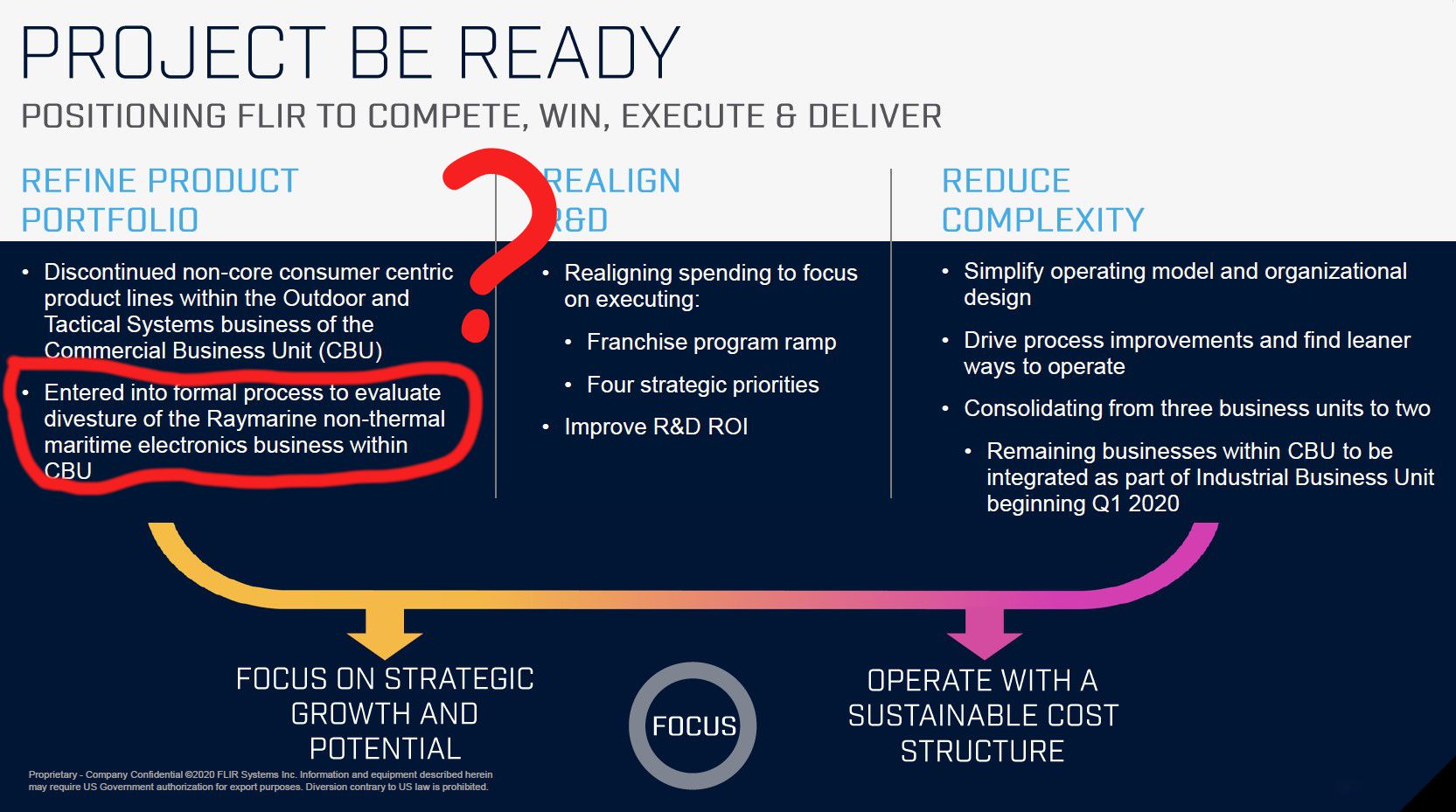

More context: FLIR’s senior management must have known they came to the conference call with bad news. In fact, the 18% drop of NASDAQ:FLIR after the call made it one of the worst-performing stocks in a very bad week. Even though management did the obvious right thing, presenting a plan to “focus on strategic growth” with concrete details like a “formal process to evaluate divesture of our Raymarine non-thermal maritime electronics business.”

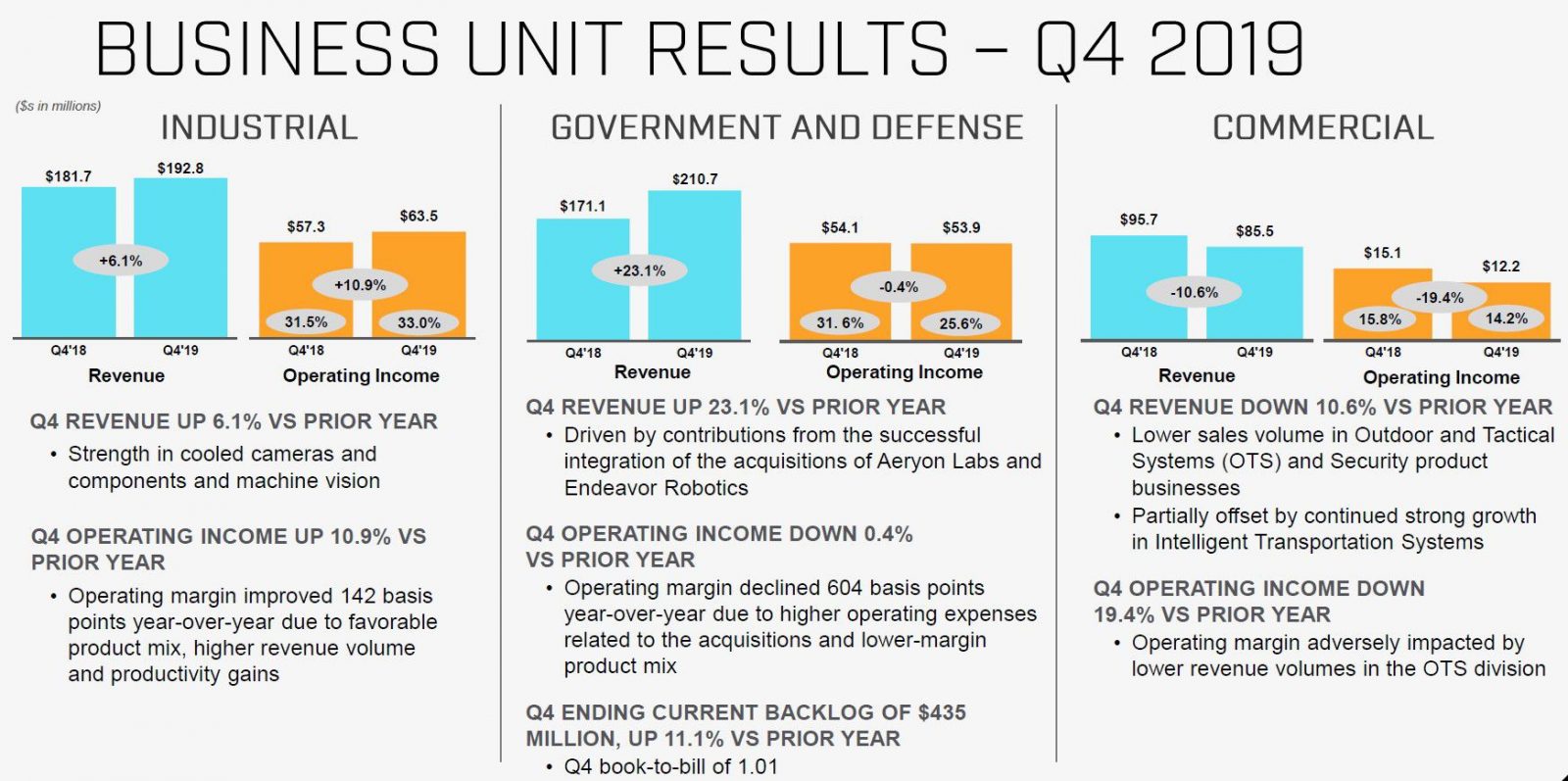

I’m certainly not a business analyst, but I don’t think that FLIR is in real trouble either. The tanking stock story is not about losing money, but rather not growing earnings as expected. And in regard to Raymarine, note that only its Commercial Unit siblings are blamed for both the lower revenue and earnings surprises.

At least by omission then, Raymarine is a healthy “little” business unit, and we’ve certainly seen their product lines improve immensely under FLIR’s wing. For instance, I don’t think that any marine brand is close in terms of managing boat cameras — thermal and otherwise, FLIR and otherwise — and that might motivate a business buyer.

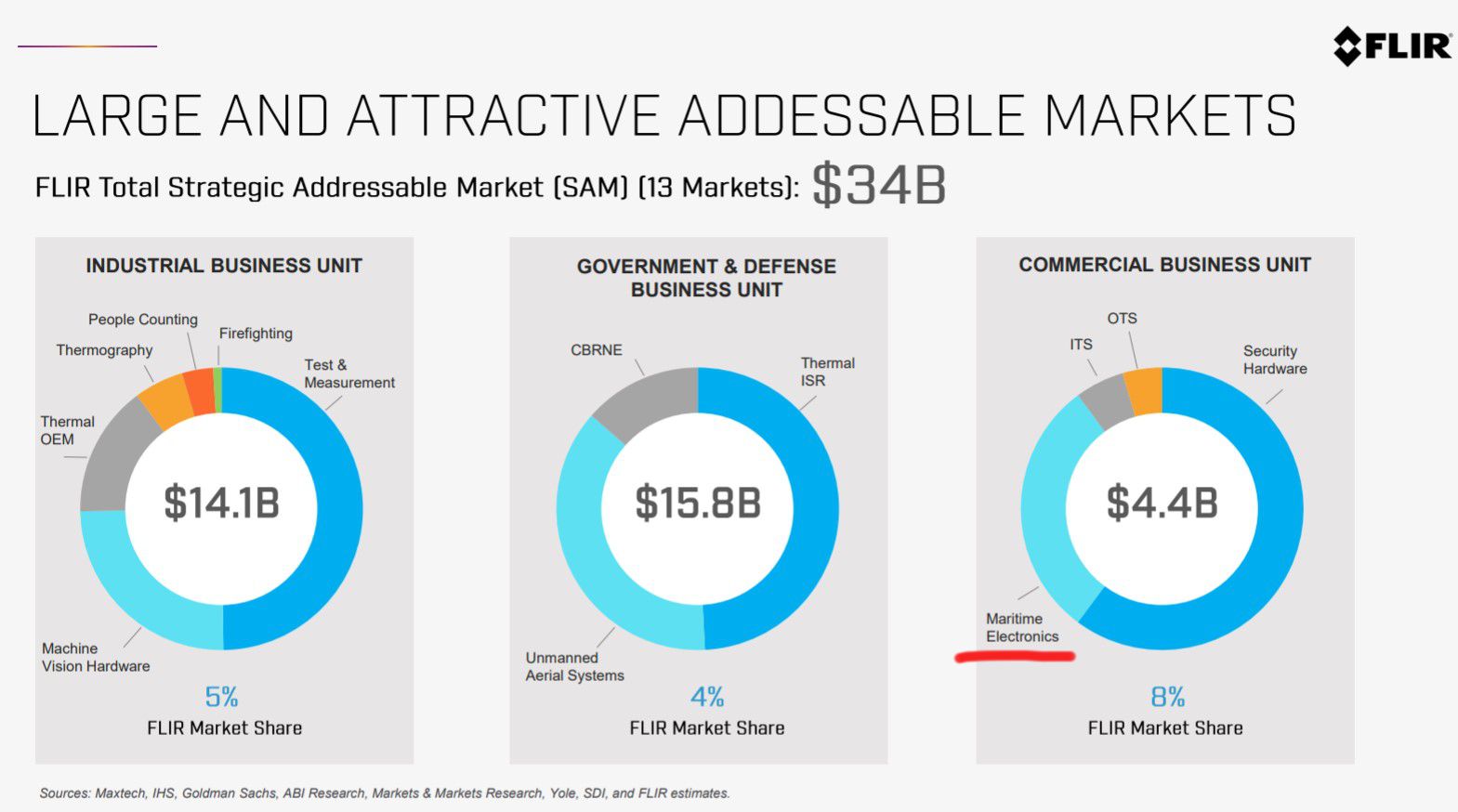

I also found this slide illustrating the estimated sizes of all the markets that FLIR sells products into. It is probably based on careful research, and the Marine Electronics section likely represents recreational marine only because that’s what the vast majority of FLIR thermal and Raymarine products address.

Moreover, FLIR’s estimate of about 1.5 billion dollars is about the same number I’ve heard for years (though it’s hard for anyone to pin it down). And a 1.5B global recreational marine electronics market is a “cottage industry” even before you consider how fractured it is in terms of brands and product variety.

Here’s another data point: While researching the new SCX satellite compass design, I learned that “since 2000, Furuno has delivered about 40,000 Satellite Compass systems to the world market.” And we know that Furuno is probably the market leader in this niche, including commercial marine. Now consider all the R&D, marketing, support, and short-run manufacturing that has gone into many Furuno sat compass models over those 20 years.

Isn’t the right question not so much “Why are satellite compasses so expensive?” as “How can they deliver such a wondrous SCX boat sensor so inexpensively?” I’ll close by quoting myself from a 2012 entry that starts with Navico market share:

… let’s consider a larger point evident in these claims. Recreational marine electronics really is a “cottage industry” as the insiders joke. If Navico’s 256 million in 2012 revenues is “more than 30% market share,” doesn’t that mean that the five largest manufacturers took in about 825 million? Heck, my local semi-rural health conglomerate has revenues well above 100 million.

And consider, say, the iPad, which had sales of 10.7 billion dollars during the last quarter of 2012. Yes, if my math is correct, essentially one consumer electronics product (iPad models aren’t much different) generated revenues of 839 million dollars per week, more than the five leading marine electronics companies generate in a year. The next time you get miffed because your navigation system doesn’t update itself as easily as a Mac, shouldn’t you consider the numbers?

Now I’ve seen a memo that went out to Raymarine dealers yesterday. Key paragraph:

“FLIR is evaluating the potential sale of the Raymarine business. FLIR strongly believes Raymarine is a best-in-class marine electronics business with a compelling and innovative product portfolio that will make the business an extremely attractive asset. During this time, the Raymarine organization will continue moving forward with active research and development, new product introductions, and world-class sales and service for the full Raymarine product line. There will be no disruptions in customer support, service, or customer warranty during this period.”

Unfortunately the marine electronics industry has been slow to embrace open source software, hardware and open achitectures.

The commerical aspects of the marine electronics industry are still stuck in the 1990s

Personal experience with B&G products has seen bricked AIS updates, Zeus products based on old linux variants and huge variability in individual sensor performance and behaviour. All very amateurish and so 1990s.

I’m sure our next major nav system update in a decade will be all open source and based on commodity hardware. The current industry players will either get with the program or go out of business.

I’ve seen this in so many sectors, automotive, motorsport, cloud computing and even defence now with major combat systems moving to an open architecture model.

I thought that Signal K was making progress in the open source direction but it seems like it’s going slowly with little commercial adoption:

http://signalk.org/index.html

There is no “may”, Raymarine has been actively soliciting buyers for a few months now, and it does not fit in at all with FLIR’s new strategy. The only questions is wether it will go to a PE-type buyer, or to an existing marine oriented brand.

I never understood why FLIR bought Raymarine in the first place, sure there is some overlap and you can try selling FLIR cameras to boaters, but wouldn’t it have been easier to sell to the entire market? They still had to do this — work with Garmin/Navico/Furuno to make sure those were also doing FLIR integration — and this became harder, not easier, when they bought Raymarine.

I personally think the current situation with 4 big brands and various smaller ones (Hummingbird, Sitex/Koden) all competing in the same area is not sustainable over the long run. As Ben says the market is not that big and currently nobody has a chance to really recoup the investment.

I checked Garmin’s financial statements: 2019Q4 report https://www8.garmin.com/aboutGarmin/invRelations/reports/2019_Q4_Earnings_Call_Webcast_Slides.pdf states total company revenue $3.758B gross margin 59.5% operating margin 25.2% — marine is ~13% of that so 480M with same sort of margins in Marine as elsewhere, that is actually much better than I thought.

Furuno 2019 FY https://www.furuno.co.jp/Portals/0/images/ir/library/annualreport/ar2019_furuno.pdf shows revenue $740M, gross profit $285M operating income $43M so if that is calculated the same for a Japanese company I get a gross margin of 285/740 = 38% and net margin of 43 / 740 = 6%. I would bet a lot of that income is from commercial, not leisure.

For Navico I could only find data for 2018 — revenue $ 373 M.

This makes the big four rather comparable in revenue size but not in margin. Adding up 480 + 30% of 740M + 373 = 1.075 M so 1.500M+- 20% for total market seems spot on.

“I never understood why FLIR bought Raymarine in the first place”

The same reason FLIR makes almost all of their decisions – sell more thermal cores. Similarly, in their CBU, they bought Digimerge/Lorex on the hope that they could push lower-end thermal cameras into the consumer/SMB video security space (spoiler alert: it didn’t work). The Lorex stuff was divested in early 2018, even though it was moving at a good clip, it did not increase sales of thermal cores measurably enough to warrant the distraction.

I think that FLIR is best not trying to be in the “consumer” business, they are better off focusing on military/government.

Hopefully Raymarine finds a good home. It is a solid product with a lot of great features and benefits, it needs to be marketed properly within the maritime industry by an owner that can focus on the brand.