MTA: Reliability or price, what matters most?

As I hope you know, the 2011 MTA marine electronics survey is underway right now, but what follows is another in a series of entries derived from the original 2010 data. As usual, I’m a bit amazed at what the MTA guys can slice and dice out of our opinions. Frankly, market intelligence is more mysterious to me than all the wires on Gizmo, but I do understand how this could help the industry serve us better. So please take the 2011 survey, and here’s MTA….

In the last MTA survey of almost 1,000 marine electronics buyers, 8 key product selection criteria were tested against 11 marine electronics market technical segments.

The 8 characteristics included:

1. Price

2. Key performance

3. User interface/ ease of use

4. Available advanced features

5. Product package

6. Product reliability

7. Low power consumption

8. Integration with other systems

The 11 general product categories (accounting for nearly 70 unique products that were also tested) included:

1. Communication systems

2. Displays and controls

3. Electrical systems and controls

4. Entertainment systems

5. Environmental sensors

6. House systems

7. Mobile systems

8. Navigation systems

9. Power generation systems

10. Propulsion monitoring and control

11. Safety systems

We asked survey respondents to rank the importance of each product selection criteria in each of the technical segments above. Yep. We asked for all that. And yes sir, we got it.

What did we learn? Read on. There is more to this than best performance at the best price.

Reliability: A Matter of Absolute Importance, and Relative Importance

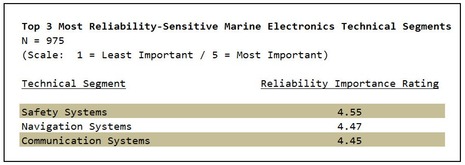

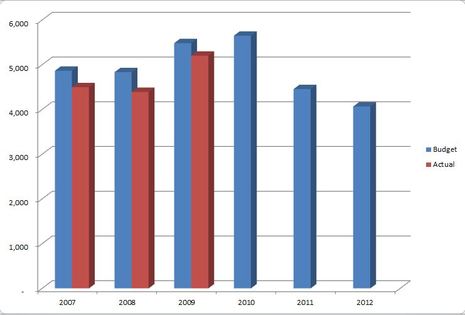

This is a performance-demanding, enthusiast market, so lets start with reliability rating. The top three technical segments, in terms of the average importance given to reliability when selecting specific marine electronics systems included:

Sure, these numbers are powerful, but, perhaps not surprising. However, we would like to point out three simple ideas:

1. At 975 respondents, and average scores around 4.5 on a 5.0 scale, this means that more than 70% of the respondents needed to score reliability a 5.0, or the most important product selection criteria.

2. Within each of these technical segments is a small cluster of specific products, each of whom might have received much lower scores

3. Redundancy was occasionally, but, seldom highlighted as a strategy for achieving higher, or highest, levels of reliability in any category.

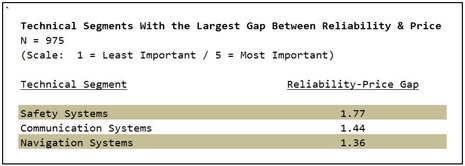

And what about that relativity thing? Well, the top three technical segments with the largest gap between average importance rating and average price rating included:

Look familiar? Again, not surprising. Until you start to consider:

1. The inferred average importance score for price (the actuals can be found in the survey results) was approximately 2.9 on that 5.0 scale – or barely of average importance.

2. That kind of rating – average importance – can imply a market that is looking for fair value, not necessarily best price.

3. When these ideas are combined with the extreme dependence on reliability, it becomes clear to MTA that demand in these markets may be among the least sensitive to price fluctuation.

Where reliability matters, and price sensitivity is anemic, suppliers can easily find themselves giving away margin to gain share. After all, the market is MUCH more concerned with reliability. Better to pitch uptime than saving a dime.

Takeaway: Buyers and Sellers Should Get Aligned on What Matters

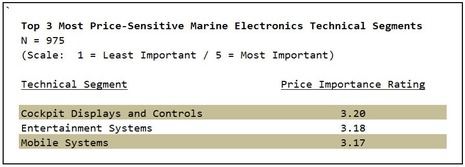

And where DOES price matter? And what is the point? Please?

Newsflash: According to the MTA survey, marine electronics users in the consumer market segment are not very price sensitive when they are specifying, qualifying and selection their solutions.

Okay, no BIG surprise here. Or is there?

Displays and Controls are only the captain’s interface to some of those systems above that respondents stated were ‘Most Important’. Mobile Systems continue to grow in importance on recreational vessels, or do they? And if they do, why are these devices not even LESS price sensitive?

On the other hand, if both of these technical segments are being ‘commoditized’ (primary differentiator is price, when most technical performance, availability and other key parameters are even), should not the price sensitivity be higher?

Well, here is a consideration: The average reliability rating for these same categories was 1.07 higher on average than their price sensitivity score. In other words, even those market segments ‘under siege’ (more on that later) by competitive, technical and commodity forces, are still not that price sensitive, at least not on the product evaluation and selection phase(s).

If the market can get and stay aligned on these two issues, there are many reasons to believe that buyers will get better value, and suppliers better margin. We all win.

Good Afternoon PANBO:

Who is taking this survey?

1. Male. 95% of respondents are male.

2. Multiple generations. Core age range is 35-70 years old.

3. Some money. More than 70% of respondents report annual earning of $250,000 or more

4. Not exclusively US. Approx 70% of respondents live in the US.

5. Diverse operating profiles. Balanced mix of sail and power. Cruising and racing. Day trippers and captains living on their boats.

What is the point? We have a good balance of operating profiles from a range male captains with moderate to high levels of technical acuity.

But we need more respondents to represent even more viewpoints.

Please take a minute and check out the survey.

Thank you.